What is Guarantor Car Finance and When is it a Good Idea?

Expert Verified

By: Verity Hogan - Personal Finance Editor

How guarantor car finance works

Get a quote

Fill out a quick application to check if you’re eligible, with zero impact on your credit score.

Meet your account manager

A dedicated Account Manager will be in touch to guide you by call, text, or WhatsApp.

Choose a car

Browse 100,000+ used cars or buy from any trusted UK dealer, it’s up to you.

Hit the road!

Tell your Account Manager what you’re after, and if approved, you could be driving in just a few days.

*Rates start from 8.9% APR - Representative example 23.9% APR

Young Car Driver partners with CarFinance 247 Limited, a credit broker (not a lender), to help find the best car finance deal for your circumstances from their wide panel of lenders. The exact APR rate you will be offered will be based on your circumstances and subject to status.

Rates start from 8.9% APR – Representative example Hire-Purchase (HP) APR of 23.9% on Hire Purchase car finance loan borrowing £6,500 over 5 years with a Representative APR of 23.9% fixed and deposit of £0.00. The amount payable is £178.13 per month, with a total cost of credit of £4187.94 and a total amount payable of £10,687.94

What is guarantor car finance?

Guarantor car finance is a type of loan that can help people with a poor credit score – or no credit history at all – find finance to buy a car.

With a guarantor loan, you’ll appoint someone who agrees to step in and make your financial repayments if you can’t. While the loan will be in your name and your responsibility, the guarantor provides an extra safety net, reassuring lenders and reducing their risk.

While no car finance option is guaranteed, having a guarantor could increase your chances of finding approval, even if you’ve been refused elsewhere.

How does guarantor car finance work?

While not all lenders offer guarantor loans, they typically work a lot like other types of car loans. Depending on your circumstances, you might be able to find a hire purchase (HP) loan or a personal contract purchase (PCP) agreement to buy a car. Both will be secured against your new vehicle, splitting the cost into affordable monthly repayments. The big difference is that there’s a third party involved – your guarantor.

As the agreement will be in your name, you’ll be responsible for making monthly repayments directly to the lender. However, the loan itself will usually be paid to your guarantor first, who will then release it to you.

If you keep up with your repayments throughout the loan term, you can pay the Option to Purchase fee and own the car in an HP loan or choose to pay the one-off balloon payment to become the vehicle’s legal owner in a PCP.

However, if your circumstances change and you struggle to keep up with your repayments, the guarantor will be expected to step in. This might not happen immediately, but if you cannot reach an agreement with your lender, your guarantor will be responsible for making payments throughout the remaining loan term.

When is guarantor car finance a good idea?

Guarantor car finance can be a good solution for drivers struggling to find loan approval on their own.

You might find it difficult to find car finance or have a loan application rejected for several reasons. If you have missed payments in the past and now have a bad credit score, are aged under 21 and haven’t yet built a credit history, or if you’ve recently had a debt management solution such as an Individual Voluntary Arrangement (IVA), your application could be considered high risk.

Appointing a guarantor with a strong credit history can help offset this risk and improve your car finance eligibility. However, it’s not the right choice for everyone. A guarantor car loan might come with additional restrictions and isn’t available from all lenders. It could also affect your relationship with your guarantor if you fall behind with your repayments and they’re forced to step in.

How is a guarantor car loan different from other loan types?

The main difference between guarantor car loans and other types of finance is that the agreement isn’t just between you and the lender. Instead, there’s a third person in the mix – your guarantor.

The guarantor provides extra reassurance to the lender and lowers the risk associated with your application if you have a bad credit score or no credit history. This is because the lender can be reasonably certain that you or your guarantor will repay the loan.

As guarantor loans have certain restrictions and require third-party involvement, they are not usually a first choice for people looking for finance. If you can qualify for a deal on your own, that may be a better option for you than choosing to pursue guarantor car finance. It all depends on your situation and financial circumstances.

What will happen if I don’t keep up with my car finance payments?

If your situation changes and you struggle to cover your financial payments, your guarantor might have to step in and make these repayments for you.

However, this is usually the lender’s last resort. Instead, they might try to contact you (or you can contact them first) to arrange a new payment plan or short payment break until you get back on track. These solutions will depend on your lender.

Even so, if you fall further behind and can’t agree with your lender, your guarantor will be asked to step in. They might find themselves responsible for covering all your outstanding payments or paying to settle the finance agreement early.

Who can be a guarantor for car finance?

Each lender has different eligibility requirements when it comes to appointing a guarantor, but in general, they must:

Be over 21 – While some lenders will accept a guarantor if they’re over 18, others will require them to be over 21 (which also gives them time to build a credit history).

Have a good credit score – someone with a good or excellent credit score will find it easier to qualify for a guarantor loan. You’re unlikely to be able to act as a guarantor if you have a bad credit score.

Be someone you trust – acting as a guarantor is a big responsibility that can impact your financial situation and credit score, so it is usually a position that falls to close friends or family members.

Be a homeowner – While it’s not always a requirement, some lenders will ask that the guarantor own their home.

You may also be prohibited from acting as a guarantor if you aren’t a UK resident, are under 18, or have a low income.

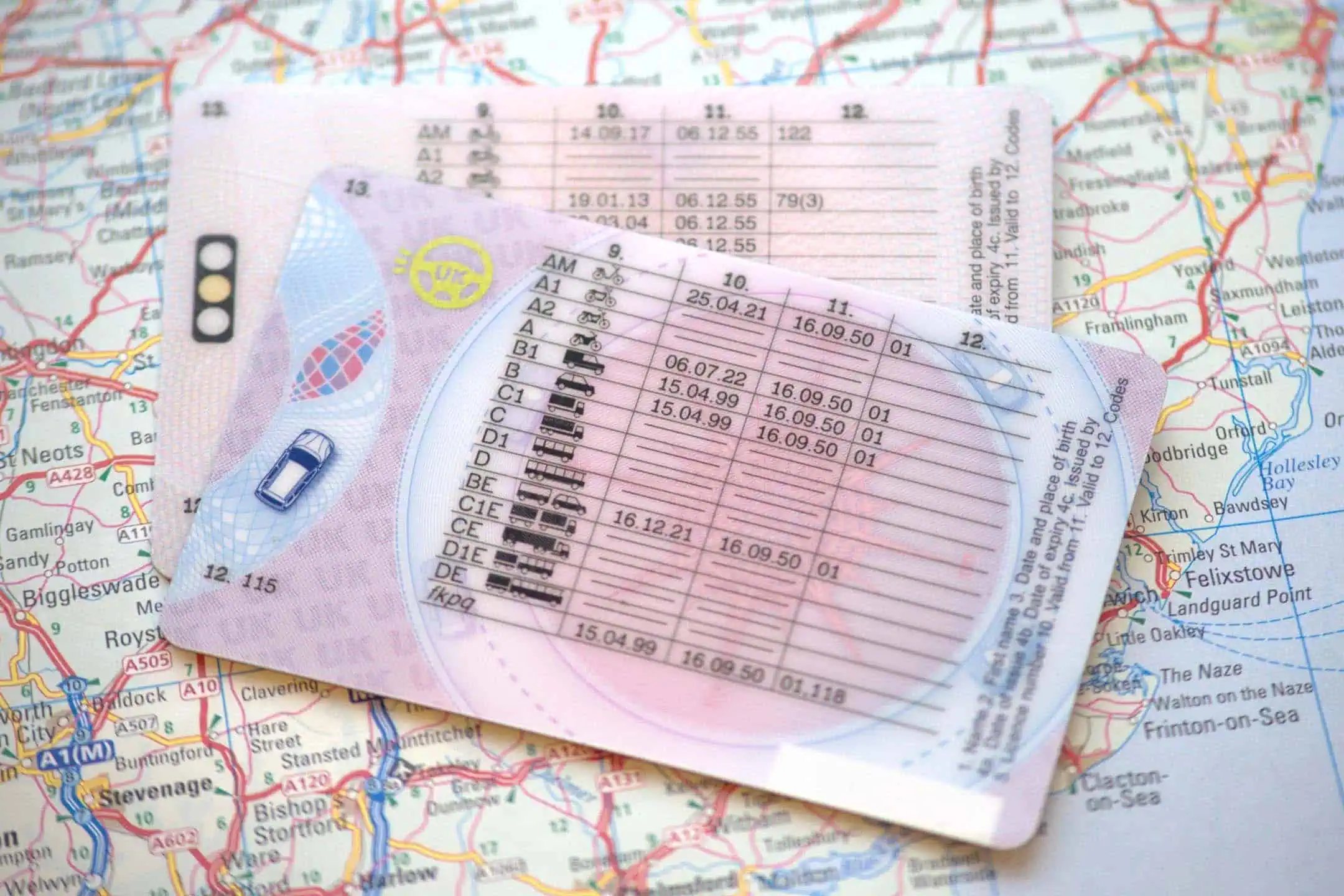

What documents will I need to apply for guarantor car finance?

The exact documents you’ll need to apply for a guarantor car loan will depend on the lender that approves you, but you’ll usually need to supply both your details and those of your preferred guarantor.

When you complete an application online or speak to your account manager on the phone, you might be asked to share details such as both your full names, dates of birth, current addresses, and employment histories.

You’ll typically also need to provide:

Proof of ID – such as a full UK driving licence or passport

Proof of income – such as recent payslips or bank statements if you’re self-employed

Proof of address – such as a recent utility bill or Council Tax statement

Being a guarantor

- What are the risks of being a guarantor?

- Will being a guarantor affect my credit score?

- Do I need to be a homeowner to be a guarantor?

What are the risks of being a guarantor?

Acting as a guarantor is a serious responsibility and one that can come with both financial and personal risks. While it could help a loved one or close friend to secure a car loan and buy a new vehicle, it’s important that you know exactly what’s at stake before committing to being a guarantor.

The biggest risk is that you might have to step in and make monthly repayments if the borrower can’t. Depending on the loan type and term, you might be responsible for paying hundreds of pounds each month for several years! This could impact your finances and your credit score if you fall behind. It could also cause personal problems between you and the borrower, especially if you feel they’ve acted irresponsibly and left you to pick up the bill.

Will being a guarantor affect my credit score?

Acting as a guarantor can affect your credit score in different ways.

Once the borrower has made an initial car finance application, both a soft and hard credit check will take place. These checks are used to assess the borrower and guarantor’s eligibility. Hard credit checks are recorded on your credit report and can be visible to other lenders for up to 12 months. If you have several hard searches on your file in a short period, this could impact your ability to find finance in the future.

It’s also worth keeping in mind that, by acting as a guarantor, you’ll be financially linked to someone with a bad credit score. This could affect your ability to get a loan on your own during their car finance term.

However, if the borrower keeps up with their repayments and reaches the end of the loan term successfully, the guarantor’s credit score should recover quickly. It’s only if you need to take over the payments – and then fall behind, too – that your credit score will be damaged.

Do I need to be a homeowner to be a guarantor?

Different lenders have different acceptance criteria; some require guarantors to be homeowners, but others don’t. If you’re not a homeowner, the lender might require you to have been based in the same place for a certain time or ask you to supply your address history for any previously rented homes. Your dedicated account manager will be happy to explain more.

Guarantor car finance for young drivers

Unfortunately, young drivers can find it hard to secure a car loan approval. It’s one of those frustrating facts of life; at 18, you can have passed your driving test, legally drive, and leave a full-time education, but still can’t qualify for car finance!

If you’re under 21, you might not have much of a credit history and an unreliable income. You could be a full-time student, have never had a credit card or loan before, or have an entry-level job that doesn’t leave you with much disposable income. This can all lead lenders to worry; your lack of credit history means they have no idea how you might act as a borrower, and an unstable or low income can affect your affordability.

Guarantor car finance for young drivers can help put lenders at ease, reducing the risk by adding a third party to your agreement. If they have a good credit score and strong payment history, your guarantor can reassure lenders that the loan will get repaid, no matter what happens to your finances.

If you do secure a guarantor loan and successfully manage the repayments yourself (without needing the guarantor to step in), this could help to improve your credit score and make it easier for you to get finance on your own in the future.