Insurance costs are higher than ever, and young drivers have it the worst. In fact, research shows that some young drivers are paying up to £3,000 just for their insurance! Fortunately, this won’t be the case forever, as your insurance costs will decrease as you get older, greyer, and more experienced.

But why are you paying so much for young driver insurance, and when will it get better?

Read on to learn more about how car insurance prices are calculated, and when your bill will likely decrease.

In this guide:

- Why is young driver car insurance expensive?

- When does car insurance start to get cheaper?

- How can you lower your premiums sooner?

Car insurance is expensive, but that doesn’t mean you shouldn’t shop around for the best price. To save up to £500, check out the Young Car Driver comparison tool.

Why is young driver car insurance expensive?

Insurers calculate your premiums based on risk, and young drivers are statistically more likely to be involved in accidents—so it makes sense that this demographic pays more than others.

Here are the main three factors that influence your insurance costs:

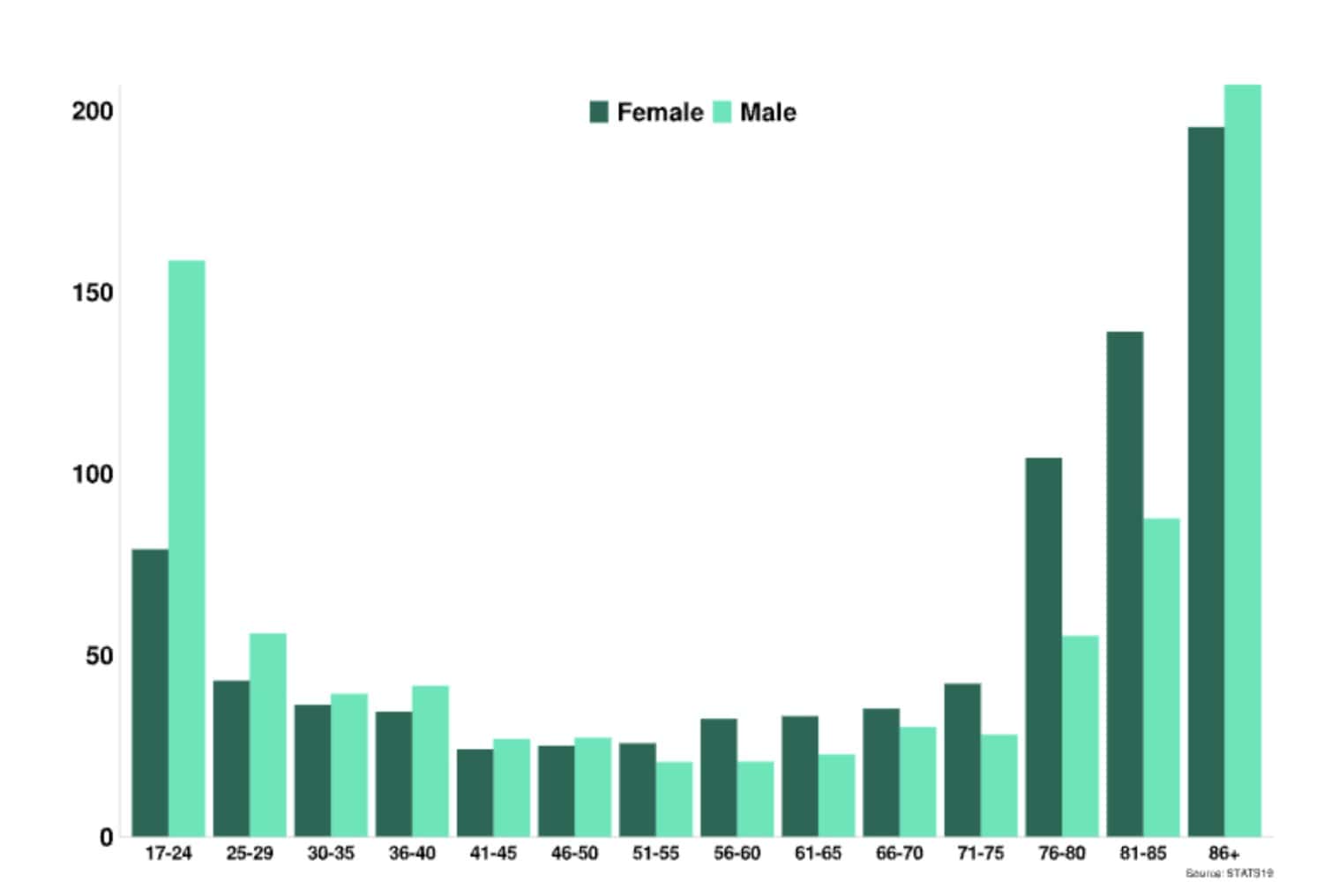

- Age and inexperience: Drivers under 25 are considered high-risk because they’re new to driving. This isn’t just a stereotype though: research shows that this age group is the most accident-prone (aside from 86+).

Car driver casualties per billion miles driven, by age and sex, Great Britain:2023 - Gender: Male drivers between the ages of 17 and 24 are four times as likely to be killed or seriously injured (when compared with all car drivers aged 25 or over). As such, male drivers tend to pay higher premiums.

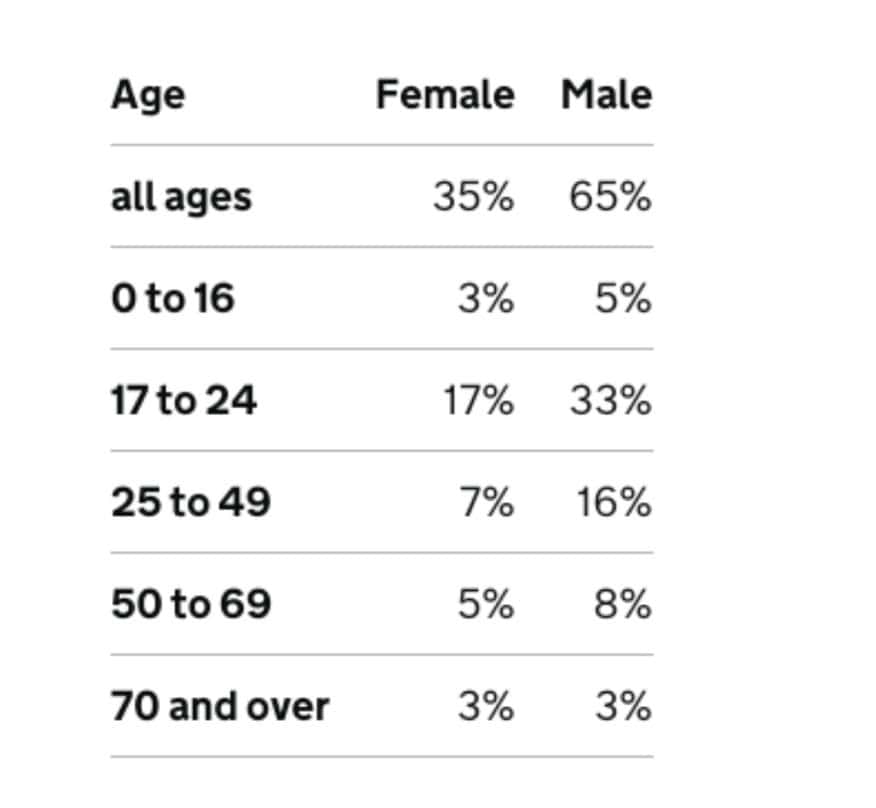

Percentage of KSI casualties from collisions involving at least one younger car driver, by sex and age, Great Britain: 2019 to 2023

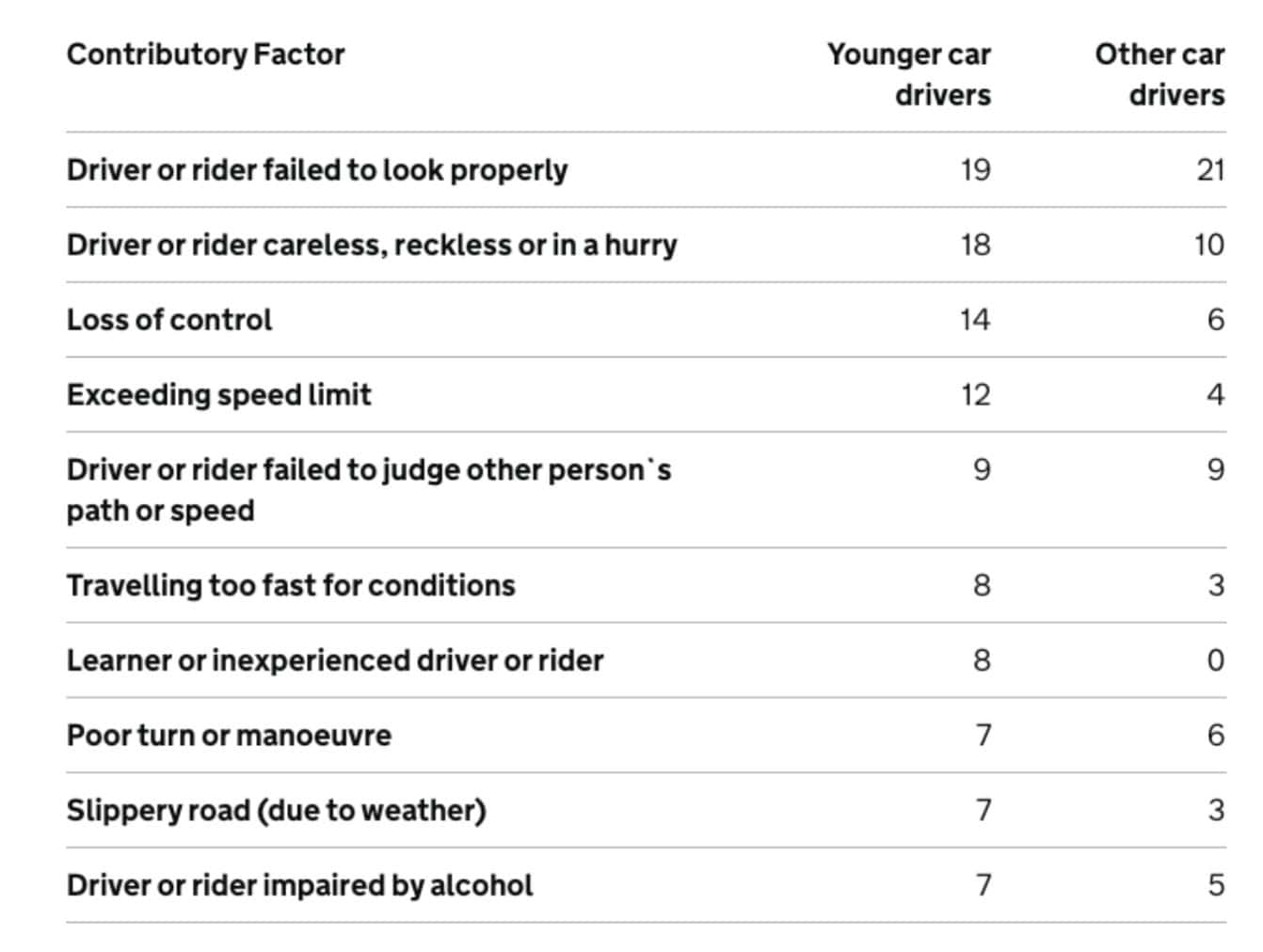

Percentage of KSI casualties from collisions involving at least one younger car driver, by sex and age, Great Britain: 2019 to 2023 - Experience: Statistics show that young drivers tend to be in accidents linked to a lack of experience, such as losing control, speeding, or poorly judging weather conditions.

Contributory factors to accidents, compared to equivalent percentage for other aged car drivers, Great Britain: 2019 to 2023

When does car insurance start to get cheaper?

As you’ve probably worked out, your insurance will decrease as you get older and more experienced.

Specifically, the cost of car insurance for young drivers typically begins to drop around the 24-25 mark.

| Age | Average Annual Premium |

|---|---|

| 17–19 years | £2,635 |

| 20–22 years | £2,099.24 |

| 24 years | £1,534.37 |

Source: uSwitch data

How can you lower your premiums sooner?

You can’t speed up time, but you can take action to try to lower your premiums. Here are six ways to do so:

1. Choose a car with a lower insurance group

Cars are assigned insurance groups based on engine size, repair costs, and safety features. Opting for a car in a lower group can make a big difference. For example, a small hatchback like a Vauxhall Corsa will cost you less than a Land Rover.

2. Consider black box insurance

Telematics policies, which use a black box to monitor your driving, reward safe driving habits with lower premiums. For instance, if you consistently stick to speed limits and avoid driving late at night, you could save money on your premiums.

3. Add a named driver

Adding an experienced driver, such as a parent, to your policy (as long as they do occasionally use the car) can help spread the perceived risk and lower your premiums. However, it’s important not to list your parents as the main policyholder if they aren’t the primary driver of the car. This practice, known as “fronting”, can result in your insurance policy being cancelled and claims being denied in the event of an accident.

4. Increase your voluntary excess

Offering to pay a higher voluntary excess can reduce your monthly premiums. Just make sure you can afford the total excess amount if you need to make a claim.

5. Shop around and compare quotes

Never settle for the first quote you get. Use comparison sites to find the best deal.

6. Join the Pass Plus scheme

The Pass Plus scheme is an additional driving qualification that helps build your skills in areas like motorway driving and night driving. Completing this course can reduce your premiums with certain insurers.

Get a quote today

Looking for ways to reduce your car insurance costs? At Young Car Driver, we specialise in finding affordable policies tailored to young drivers.

Whether you’re building your no-claims bonus or looking for a telematics option, we’ll help you find the right coverage at the best price. Get a quote today.

Sources:

Percentage of KSI casualties from collisions involving at least one younger car driver, by sex and age, Great Britain: 2019 to 2023

Percentage of KSI casualties from collisions involving at least one younger car driver, by sex and age, Great Britain: 2019 to 2023