What is a balloon payment on a car?

Expert Verified

By: Verity Hogan - Personal Finance Editor

Why balloon payment?

The ‘balloon payment’ official name is the Guaranteed Minimum Future Value (GMFV). However, that’s not catchy, so most people call it the ‘balloon’ payment because of its large size!

A balloon, also called the optional final payment is a lump sum owed to the finance company at the end of a PCP deal.

Our content explains everything you need about car finance with balloon payments.

What is a balloon payment on car finance?

Do you think it’s time to change the car? If so, you may consider taking out car finance, enabling you to make monthly repayments and spread the costs. If you do not want to own the vehicle outright, PCP car finance with a balloon payment is likely the best option.

The balloon payment makes PCP finance attractive to buyers of both new and used cars. By deferring a significant part of the purchase price until the end of the contract, the balloon payment makes car finance more affordable. It enables you to drive a better or newer vehicle than you might otherwise.

To own the vehicle, you must pay the lump sum at the end of a PCP car finance contract.

How do balloon payments work for cars?

PCPs have three specific numbers, including the balloon payment.

- Purchase price of the vehicle.

- Amount the car will depreciate.

- Balloon payment (value of the car at the end of the PCP).

Balloon payment example:

You take on a PCP to finance a car valued at £14,000.

- The contract is over three years.

- The vehicle’s value at the end of the PCP is estimated at £9,000.

- With monthly payments, you pay the difference of £5,000 (the amount the car will depreciate).

- You’ll have the option of making the balloon payment of £9,000 at the end of the contract to own the vehicle.

Overview

In this instance, a PCP can offer lower monthly payments than other finance options such as hire purchases. You only pay the £5,000 the car depreciates and not the £14,000 the car is worth.

Monthly repayments pay off the car’s depreciation value, not the purchase price.

If you want to keep the vehicle after three years, you pay the final lump sum payment of £9,000. You will then have paid the total £14,000 value of the car.

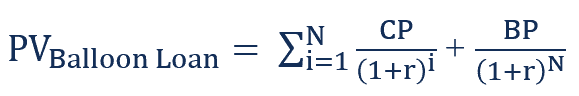

How do you calculate a balloon payment?

The balloon payment value is the result of a separate calculation.

Purchase Price – Depreciation + Interest Charges for the Loan and Balloon Payment = The Balloon Payment.

Or, for those keen mathematicians!

Where:

- CP = Constant payment

- BP = Balloon payment

- N = number of payments

- r = Discount rate

What do the monthly payments cover?

After calculating the final depreciation of the vehicle, the lender can calculate your monthly repayments.

Your monthly payments repay the value the car will depreciate, plus the interest on both the loan and the balloon payment.

How can the balloon payment influence your choice of car?

With PCP finance, you can wait until the end of the contract to decide if you want to buy the car outright (make the balloon payment) or return the vehicle.

However, we suggest before you sign up, work out the total costs over the life of the PCP deal and determine what’s best for you financially. Your intention to keep or return the car when the agreement finishes may influence your choice of car.

The car’s depreciation affects the balloon payment

Suppose you only want the vehicle for the duration of the PCP. You have no intention of paying the lump sum when the contract ends. You’re going to give it back!

Choosing a vehicle that holds its value well will help reduce your monthly repayments. However, the optional balloon payment will be much higher for a car that depreciates heavily! Not your problem because you don’t want to keep the vehicle, but you will enjoy lower monthly repayments.

Higher depreciation of the car

‘the more a car depreciates, the higher your monthly payments and the lower the Balloon.

Lower depreciation of the car

‘the less a vehicle loses value, the lower your monthly repayments but a higher balloon.

What’s best for you?

You’ll have to determine what works best for you, but as a guide, the monthly repayments usually add up to more than the depreciation.

Do you have to pay the balloon payment?

You don’t have to make the balloon payment at the end of a PCP finance agreement. Many people don’t. Paying up is just one of several options. PCP can be helpful for those that want to change their car regularly.

What happens when a balloon payment is due at the end of a PCP deal?

You have three options when the contract finishes:

1. Return the vehicle and pay nothing extra (unless you have mileage or damage penalties, see below).

2. Pay the lump sum and own the car. (you can pay cash or refinance the lump sum payment, more info below).

3. Return the vehicle and get new car finance (If the car is worth more than the Balloon, you can use that equity towards a new car finance contract).

What happens if the car is worth more than the Balloon (positive equity)?

The vehicle’s value will most likely be more than the balloon payment at the end of the PCP. Finance companies are cautious when estimating balloon payments. They prefer the car to have equity and not to be worth less than the final lump sum payment.

From the borrower’s perspective, a car worth more than the balloon payment is good. It means there is positive equity in the vehicle. Giving options to:

- Pay the final lump sum and keep the car, knowing it is worth more than the amount paid. Or,

- Return the vehicle using the equity towards another PCP car finance deal with the same dealer or finance company.

What if you want to return the car?

However, if you want to give the car back? You’ll lose out because the equity stays with the finance company.

If you return a car with positive equity, will you lose the money?

Returning a car to the finance company and losing a couple of hundred in equity because the vehicle is worth more than the balloon payment might not hurt much.

However, you don’t want to give that away if the car has a decent surplus.

You could:

Part-exchange the vehicle for another car from a dealer. With the dealer paying the balloon payment to the finance company on your behalf, the surplus cash goes towards your next vehicle.

You make the balloon payment and sell the car for more than you paid, leaving a surplus amount.

Some finance companies will agree to you selling the car before paying the balloon payment. You then pay back the money owed and keep the balance. Result!

What if the car value is less than the balloon payment (negative equity)?

The Balloon might be too high, and the vehicle’s value is less than initially predicted. Don’t panic – it’s not your problem if the car doesn’t reach the balloon payment calculated for the end of the PCP contract. It’s not your car! And you don’t have to make the balloon payment.

The Balloon is a safety net and protects the borrower from any unexpected fall in the car’s value. You won’t pay if there is a shortfall. The finance company takes the hit. They’re the ones who made the calculations.

Can excessive damage or mileage increase the balloon payment?

No. Nothing will affect the balloon payment value. It will not go up or down, no matter what.

However, suppose you are taking out car finance with a balloon payment anytime soon. There may be a tendency that the end of the agreement is so far away that excessive ‘wear and tear’ to the vehicle is not something to worry about now.

A PCP agreement contains penalties for excess damage to the vehicle

But, with a PCP, when you sign up, you agree to return the vehicle in reasonable condition because the dealer will base the car’s depreciation value on a set of usage assumptions. As discussed above, the expected depreciation helps set the balloon payment value.

When you return the vehicle, the car finance company expect the vehicle back in a condition aligned with the mileage and age. They will accept any damage deemed fair wear and tear.

Excess damage to the vehicle can affect financial penalties

However, return the car with the bodywork full of dents and scrapes and the interior torn and stained with mileage significantly more than the agreed limit. Although the balloon payment won’t go up, you might receive a substantial financial penalty for your efforts.

Can I refinance the balloon payment on a car?

The final balloon payment can be a large chunk of money to find in one go. So is further car finance an option?

You can refinance the Balloon payment on a PCP car finance deal, usually with a new lender.